-

Voyagez avec nous dans le temps, à une époque où les graphiques pixélisés et les sonorités 8 bits régnaient en…

-

La science-fiction, c’est un voyage dans l’inconnu, une exploration des confins de l’univers, une plongée dans des mondes parallèles où…

-

Offrez-vous un moment de détente en plein air tout en préservant votre budget et l’environnement. La douche solaire est le…

-

Partez à la découverte d’un monde fascinant et passionnant : le monde des bateaux. Quels sont les différents types de…

-

L’ère numérique a accru le besoin de sécurité et de confiance pour les réseaux informatiques. Les firewalls/pare-feus constituent une solution…

-

Qu’est-ce qui fait la force et le succès de l’économie de marché ? L’importance de saisir les mécanismes, avantages et…

-

La recherche d’une clôture flexible et durable peut offrir des avantages considérables pour le jardin, la propriété ou tout type…

-

Les Saveurs Authentiques, un magazine de l’art de vivre gourmand. Pour ceux qui recherchent des saveurs et des expériences inoubliables,…

-

Comment choisir, sécuriser et optimiser l’espace de votre coin lecture avec une échelle bibliothèque

Lorsqu’il s’agit de trouver un moyen pratique et élégant pour ranger vos livres, archives ou documents, les possibilités sont nombreuses.…

-

Vous rêvez d’un lieu paradisiaque, loin du tumulte de la vie quotidienne et riche en activités à couper le souffle…

-

La Tanzanie est un pays d’Afrique situé au-delà de l’imagination. Cette terre riche en safaris, plages et trésors naturels offre…

-

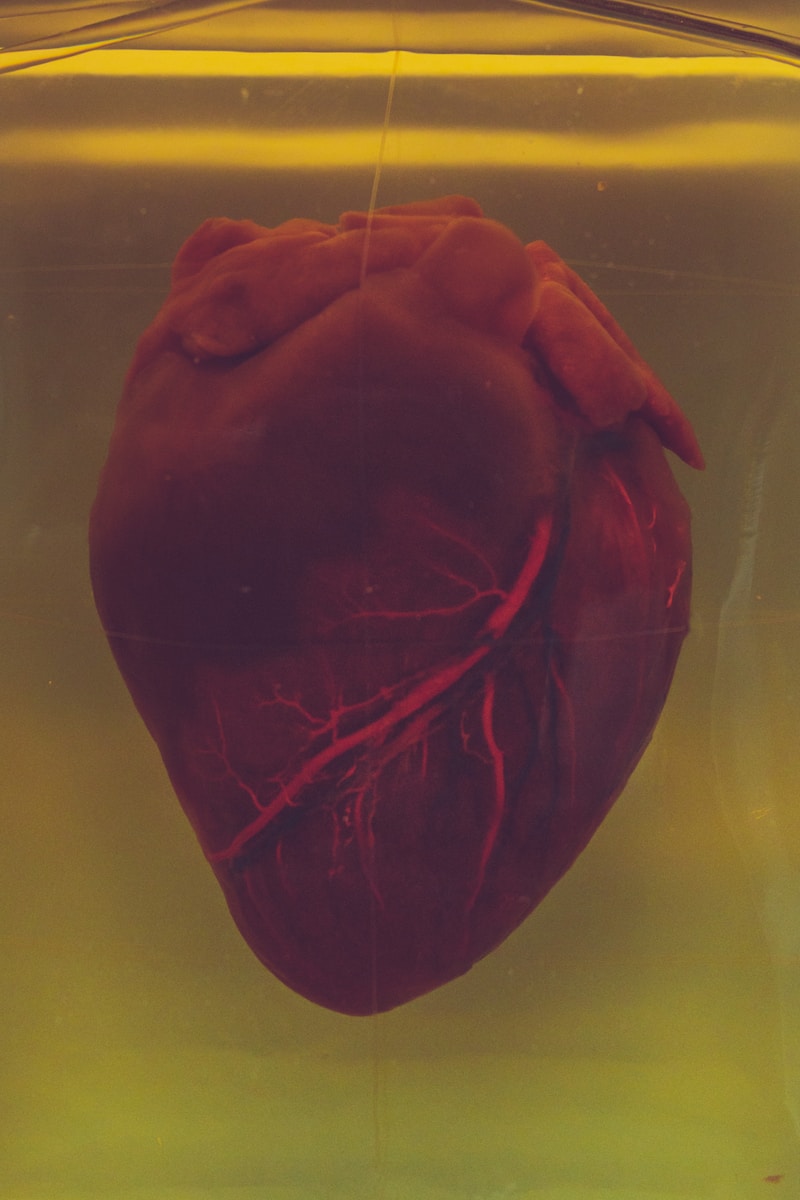

Les cardiaques sont souvent associées au stress ou à des activités physiques intenses. Cependant, il existe beaucoup plus de causes…

-

Le désir de plusieurs femmes est d’avoir de beaux cheveux. Les fabricants s’évertuent donc à ressortir de nombreux produits, pouvant…

-

Ces dernières années, les box mensuelles ont connu un essor incroyable. Elles sont devenues omniprésentes et de plus en plus…

-

L’eau est un liquide nécessaire à tous les êtres vivants. Il participe grandement à la survie de l’espèce humaine. L’espèce…